After months in lockdowns and living under tight restrictions, many Australians have gone on a “revenge spending” spree. But before you go out and buy buy buy, do a financial stocktake to see if those purchases are viable and that your emotions aren't ruling your reality.

Month: November 2021

SMSFs flagged on updates to contribution measures in upcoming super bill

The new recently introduced bill on enhancing superannuation outcomes has provided a further update on how the government will implement its new contribution rules along with its potential effect on contribution strategies for SMSFs.

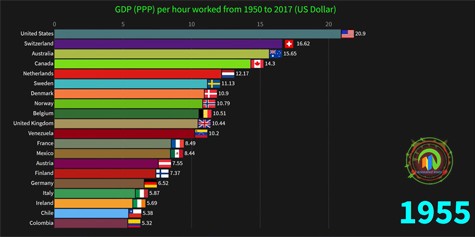

World’s most productive countries

The following animated chart covers the period from 1950 to 2017. It is fascinating to see how the world changes over time.

Three behavioural factors that can affect retirement spending

Retirees work hard to build up their nest egg but many are hesitant to spend it when the time comes. Here are three behavioural factors that affect retirement spending and how you can overcome them to ensure you make the most of your later years.

New FAR regime and CSLR changes before Parliament

The Morrison government has introduced legislation into Parliament to establish the Financial Accountability Regime (FAR) and the Compensation Scheme of Last Resort (CSLR).

Planning your financial legacy

Beyond accumulating wealth over time, planning your financial legacy is one of the most important aspects of estate planning. With the greatest family wealth transfer set to occur in the next 20 to 30 years, here are a few things investors should consider when planning.

ASIC releases new guidance on crypto investment products

ASIC has released new regulatory guidance for product issuers and market operators on how they can meet their regulatory obligations in relation to crypto-asset exchange traded products (ETPs) and other investment products.

ATO extends COVID-19 relief for SMSFs

The ATO has made an extension to several COVID-19 compliance relief for SMSFs to cover the 2021-22 financial year.