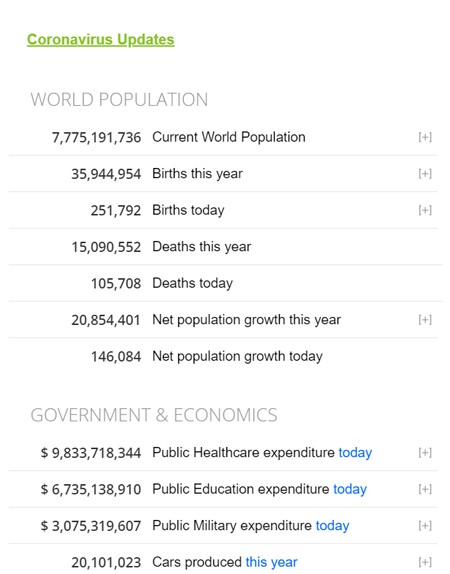

The following website gives the running totals for many everyday categories and the numbers are almost, if not, overwhelming when seen on a global scale.

Financial Planning

Ride the market to recovery

Severe market downturns feel anything but fair. In many ways the biggest risk facing investors now is the impulse to take action and to make hasty, short-term decisions based on emotional factors rather than accepting where we are today and riding things out.

Historic $130bn wage subsidy to cover 6 million workers

Prime Minister Scott Morrison has now unveiled an extraordinary $130 billion wage subsidy which will see businesses receive $1,500 a fortnight per employee for the next six months.

Stage 2 – Covid-19 stimulus package.

Detail on what the second stimulus package means to your hip pocket, Centrelink payments and staff retention.

Covid-19 Update – Small Business

Small businesses will be the hardest hit by the ramifications of Covid-19. The following is more information to help small business owners better understand some of the business support that's now available.

PM launches $17.6 billion virus stimulus plan

The Prime Minister has announced a stimulus plan to curb the economic impact of the coronavirus and keep “Australians in jobs and businesses in business”.

What 2020 holds for low cost funds

As it goes, 2020 is unlikely to bring a period of prolonged stability that investors are hoping for.

Non-concessional contributions breaches on ATO radar

Deliberate efforts to game non-concessional contributions (NCC) cap breaches to reduce tax are known to the ATO, which will consider them as tax evasion.

Non-concessional contributions breaches on ATO radar

Deliberate efforts to game non-concessional contributions (NCC) cap breaches to reduce tax are known to the ATO, which will consider them as tax evasion.

Expected GDP by country 2010 to 2100

This animated chart is simply amazing but some world events could have a negative impact. Even so, it's fascinating to see how the world might change into the future.

Investing with small amounts

A question that comes up for many people saving for retirement is how best to invest when they only have small amounts of money available at a time.

A resource hub for our clients.

We provide 24/7 access to many extra tools and resources to help you build on what we offer concerning your tax and other financial affairs. *