The 2024 Federal Budget is broken down into these five PDFs. Click on each to read more.

Financial Planning

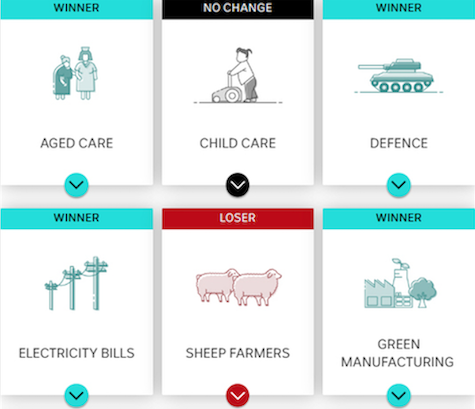

Winners & Losers

Jim Chalmers has handed down the government's third budget, with a $300 power bill boon for every Australian household, but the purse strings kept tight on other measures.

Federal Budget 2024

Four main components of this year's Federal Budget can be seen by using the following links.

Investment and economic outlook, April 2024

Our region-by-region economic outlook and latest forecasts for investment returns.

Winners & Losers

Jim Chalmers has handed down the government's third budget, with a $300 power bill boon for every Australian household, but the purse strings kept tight on other measures.

What is the future of advice and how far off is superannuation 2.0?

Financial advice can make a massive difference in people’s lives. We know this because we see every day in our data just how much better off people are when they follow the advice. But up until now, the majority of Australians haven’t been able to afford it. As a consequence, most Aussies are unaware of what advice is and how it can help them be better off.

Getting to a higher level of financial literacy in Australia

The practical benefits of improving financial literacy.

Oldest Buildings in the World.

Check out the oldest Buildings in the World.

The compounding benefits from reinvesting dividends

Using income distributions to purchase additional ETF units can significantly compound capital growth and income returns over time.

Investment and economic outlook, March 2024

Region-by-region economic outlook and latest forecasts for investment returns.

The 2025 Financial Year Tax & Super Changes You Need to Know!

The new financial year is fast approaching and so are a number of changes to superannuation contribution amounts and the individual tax rates. These changes are outlined below, as is some information on how you may be able to work with these changes when managing your tax affairs during 2024-25.

The 2025 Financial Year Tax & Super Changes You Need to Know!

The new financial year is fast approaching and so are a number of changes to superannuation contribution amounts and the individual tax rates. These changes are outlined below, as is some information on how you may be able to work with these changes when managing your tax affairs during 2024-25.