ATO releases new guidelines to combat identity theft

ATO and the Tax Practitioners Board have developed new client verification guidelines for tax practitioners, with criminals using increasingly sophisticated attempts to steal taxpayer identities

ATO and the Tax Practitioners Board have developed new client verification guidelines for tax practitioners, with criminals using increasingly sophisticated attempts to steal taxpayer identities

The non-arm’s length income rules for superannuation will result in unwarranted and significant detriment to fund members and could operate in conflict with a range of trustee duties, including the best financial interests duty, joint bodies have told the government.

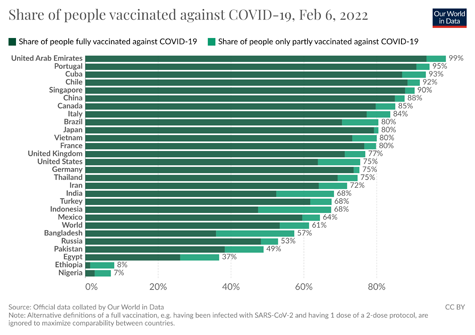

61.4% of the world population has received at least one dose of a COVID-19 vaccine. 10.2 billion doses have been administered globally, and 18.22 million are now administered each day. Only 10% of people in low-income countries have received at least one dose.

While the draft regulations aimed at tackling the excess transfer balance issue are a welcome development, SMSF trustees will have to hope the ATO releases the excess notice determination quickly to avoid interest building up, according to Heffron.

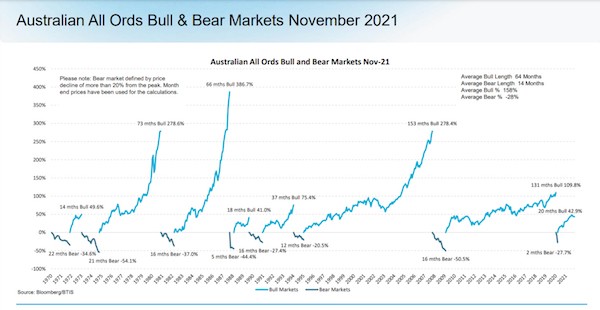

2022 is set to be a bumpy year for investors, but sticking to an investment strategy and thinking long-term will help investors navigate the road ahead.

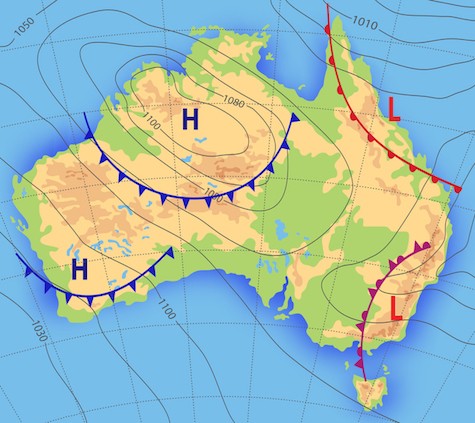

Investment forecasts, just like weather forecasts, should be used to help inform but not entirely drive decision-making.

The ATO will only recognise limited reasons offered by trustees as an acceptable excuse for not paying a death benefit within the standard timeframe.

The use of various entities to jointly qualify for the “sophisticated investor” status will need to navigate various legal hurdles, especially around control for structures such as SMSFs and trusts, according to a law firm.

10 little-known pension traps proving the value of advice.

An explanation of the difference between a Bull and Bear run.