Take action on valuations now to avoid delays, says ATO

The ATO is urging SMSFs to get their asset valuations done before their annual audit to help avoid delays and late lodgements.

The ATO is urging SMSFs to get their asset valuations done before their annual audit to help avoid delays and late lodgements.

There is quite a bit of truth to the old adage “there is no free lunch in life” or its more recent equivalent “if you’re not paying for the product, you’re the product” because pretty much everything in life comes at a cost these days.

The ATO is paying closer attention to attempts by accountants to “patch up” mistakes by SMSF clients involving the removal of money from the fund.

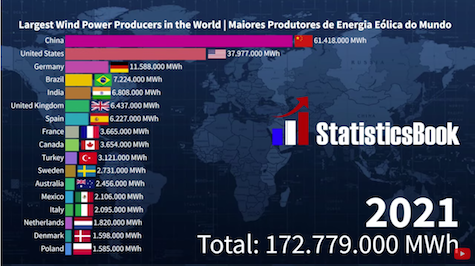

Check out the worlds largest wind power producers from 1990 to 2021

Six biggest bull markets in US stocks/shares since 1962 and their subsequent bear markets.

SMSFs have been warned on some of the challenges in proving ownership of crypto assets, with only certain exchanges allowing SMSF accounts to be registered.

If you operate some or all of your business from your home, you may be able to claim tax deductions.

To avoid additional costs (including the superannuation guarantee charge (SGC)), you must pay the right amount of super for all your eligible employees by the quarterly due date.