Tax Office homing in property deductions, SMSFs warned

With property deductions a big focus for the ATO this tax time, SMSFs have been warned on some of the pitfalls in this area that can land them in trouble.

With property deductions a big focus for the ATO this tax time, SMSFs have been warned on some of the pitfalls in this area that can land them in trouble.

Wayward habits accentuated by the pandemic will be a compliance focus.

Thorough documentation can help mitigate the risk of crypto assets going missing in situations like divorce, says a specialist lawyer.

From navigating market volatility to superannuation legislation changes to determining the right asset allocation, here's how financial advice can help investors optimise their portfolios.

A specialist law firm has highlighted the importance of ensuring that the bare trust has been set up correctly where SMSFs are looking to borrow money.

There's a common misperception that in order to start investing, you need a large initial sum and lots of time. Here's why that's a myth.

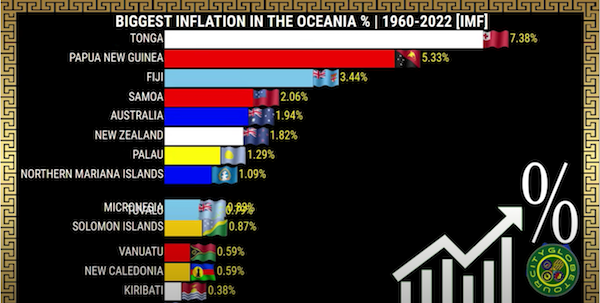

See how the inflation rates changed from 1960-2022

Investing in familiar names may bring a sense of comfort but by focusing too heavily on the Australian market, investors may limit their opportunity set and forgo the benefits of greater diversification.

Search through the data collected by the Australian Bureau of Statistics, and find interesting facts about how the country is changing.

The total value of SMSF assets has climbed to $892 billion during the 12 months to March, according to the latest ATO statistics.