ATO responds to GST case involving SMSF

The ATO has issued a decision impact statement on a recent decision that determined whether an SMSF was liable for GST on the sale of subdivided lots.

The ATO has issued a decision impact statement on a recent decision that determined whether an SMSF was liable for GST on the sale of subdivided lots.

The more detail you can give your accountant the quicker your tax return can be processed and, usually, the better the outcome. The following will help.

From 1 July 2022, there will be changes made to super to make it easier for Australians to grow their retirement savings.

Trusts are used to hold assets for various reasons, but most typically for tax planning and asset protection purposes. Here's a little more insight into how trusts work.

The contribution changes coming in on 1 July will provide more time for spouses in SMSFs to even up their balances and maximise their transfer balance cap, according to an advisory firm.

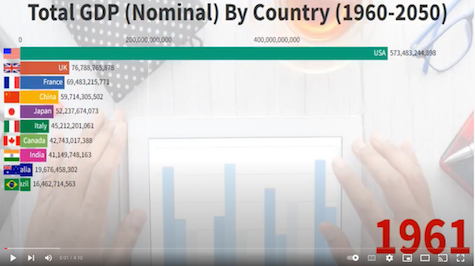

The following animated chart covers the period from 1950 to 2017. It is fascinating to see how the world changes over time.

While the official interest rate increase has seen some SMSF lenders raise their interest rates, others are holding off for now.

New rules are in effect, which will see changes to how SMSFs manage transfer balance lodgement.

With only about four weeks left until the end of this financial year, now's a good time to check your superannuation options.