A proven way to build wealth

Reinvesting income distributions and having the discipline to contribute regularly is a powerful way to build wealth, as evidenced in Vanguard's 2021 Index Chart.

Reinvesting income distributions and having the discipline to contribute regularly is a powerful way to build wealth, as evidenced in Vanguard's 2021 Index Chart.

Retirees face a variety of risks in retirement including market risk, inflation risk and longevity risk. Here are some strategies to help mitigate them so you can achieve financial peace of mind.

Individuals can now recontribute amounts they withdrew under the COVID-19 early release of super program.

While society continues to grapple with the factors driving gender and pay inequity, women are proactively turning to investing more than ever before. And in doing so, they are demonstrating a very competent and sensible approach to building up their wealth outside of superannuation.

Victoria endures its sixth lockdown as the state's cases grow; NSW records 1,281 new local COVID-19 cases and three deaths. Lockdowns to be eased once 70% of the population is double vaccinated against COVID-19 yet today some 60% of Australians are in lockdown.

SMSFs are looking to invest more in equities and less in cash in this low-yield environment, according to the Vanguard/Investment Trends 2021 SMSF Investor report released last week.

SMSFs are looking to invest more in equities and less in cash in this low-yield environment, according to the Vanguard/Investment Trends 2021 SMSF Investor report released last week.

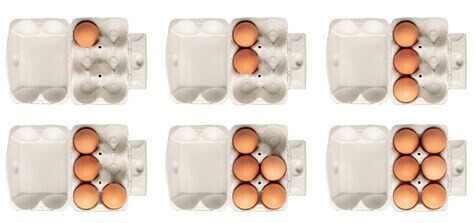

SMSFs will be able to add a fifth or sixth member to the fund using the Australian Business Registry from mid-August.

SMSF members are highly satisfied with their choice of superannuation fund and the sector has topped satisfaction ratings across all types of funds.

Making our website into a valuable resource for our clients is very important to us.